How to build a fintech app: a practical guide for entrepreneurs

As financial technology continues to redefine the boundaries of traditional banking and investment, the development of fintech apps stands at the forefront of technological innovation, providing entrepreneurs with a gateway to disrupt traditional financial services. With the rise of digital innovation, these apps have become instrumental in reshaping how individuals manage their finances, offering convenience, efficiency, and accessibility.

Some interesting figures: According to the Ernst & Young Global FinTech Adoption Index, 60% of customers want to transact with financial institutions that provide a single platform, such as social media or mobile banking apps. Plus, 64% of people worldwide used one or more fintech platforms back in 2019, up from 33% in 2017.

As the demand for innovative financial solutions continues to surge, there is a need to meet that demand by developing a personal finance management, lending, insurance, banking application, or a groundbreaking investment platform. This article contains a practical guide on how to build a fintech app tailored to empower entrepreneurs in navigating the multifaceted landscape of fintech app development.

Diving into fintech software development

Embarking on the journey of building a fintech app demands a holistic understanding of market dynamics, regulatory frameworks, technological intricacies, and user expectations. Translating fintech aspirations into a tangible, user-friendly, and secure digital reality is of the essence. When making these efforts, you are also supposed to get prepared for probable challenges related to developing fintech custom software. Once all the preparations are done, let’s walk through the essential steps of building a fintech app, from conceptualization to post-launch review.

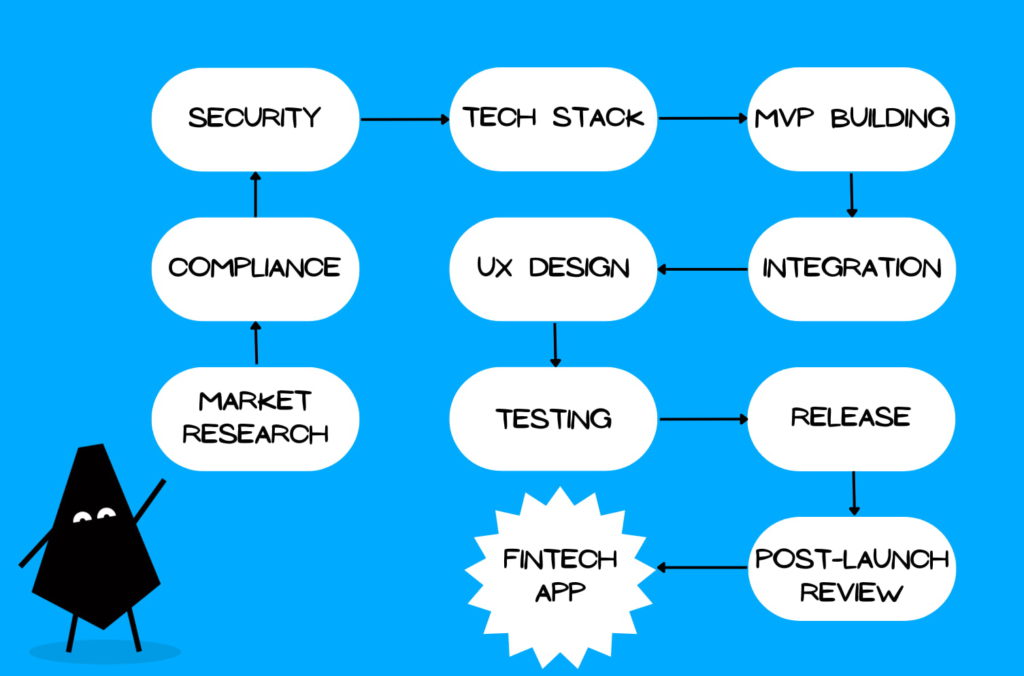

Steps for a smooth fintech app development

1. Conducting app market research

- Understanding user needs and market trends: The foundation of a successful fintech app lies in a profound understanding of user needs and current market trends. Through comprehensive market research for apps, you can identify gaps in existing solutions and pinpoint unique features that cater to the evolving demands of their target audience. This initial phase sets the stage for a purpose-driven fintech app development process.

- Identifying a niche in the fintech ecosystem: Given the expansive nature of fintech, pinpointing a specific niche is essential. Whether it’s personal finance management, peer-to-peer lending, or investment platforms, a well-defined niche not only streamlines app development but also enhances the app’s marketability. Understanding the nuances of your chosen niche will guide subsequent decisions on how to build a fintech app.

2. Navigating compliance and regulations

In the fintech sector, compliance with financial regulations is non-negotiable. You must collaborate with legal experts to get advice on complicated frameworks, including the General Data Protection Regulation (GDPR), anti-money laundering (AML), Know Your Customer (KYC) regulations, and the Payment Card Industry Data Security Standard (PCI DSS). A solid legal foundation is imperative to guarantee the app’s legality, security, and user trust.

3. Ensuring fintech app security and secure data management

Security is paramount in fintech app development. Robust data encryption protocols and two-factor authentication (2FA) are critical components in safeguarding sensitive user information. You must prioritize the implementation of security features, ensuring the resilience of your fintech app against emerging cyber threats. Enhancing cybersecurity will not be superfluous at any stage of fintech app development.

4. Paying attention to how to choose a technology stack

Choosing the right technology stack is a crucial decision in developing a fintech app, as it directly influences the app’s performance, security, and scalability. You must evaluate factors such as platform compatibility, database management systems, server infrastructure, and programming languages. The choice of technologies will depend on factors such as the app’s specific requirements, target audience, and the development team’s expertise. A well-informed choice ensures the stability and reliability of the app. Here you can consider some typical choices:

Backend development:

- Server-side scripting: Node.js, Python (Django or Flask), or Java (Spring Boot) are common choices.

- Database: choose a secure and scalable database. Options include MySQL, PostgreSQL, MongoDB (for NoSQL), or Oracle.

- Server infrastructure: Cloud services such as AWS, Azure, or Google Cloud offer scalable and reliable server infrastructure.

Frontend development:

- Programming languages: Choose languages known for their security and performance, such as JavaScript (for web apps) and Swift or Kotlin (for mobile apps).

- Frameworks and libraries: for web apps: React.js or Angular.js; for mobile apps: React Native for cross-platform or native development with SwiftUI (iOS) and Jetpack Compose (Android).

5. Determining key features and building an MVP

With a solid understanding of the market and regulatory landscape, the next crucial step in fintech app development involves defining the key features and crafting a Minimum Viable Product (MVP). An MVP is a simplified version of the app that includes essential features, allowing you to test the concept, gather user feedback, and make informed decisions for further development. So, this step is about:

- Prioritizing core functionality: focus on implementing the core features that define the app’s purpose and value proposition and define the key values and user stories that will form the basic functional scope of the first release.

- Scalability considerations: build the MVP with scalability in mind, ensuring that the app’s architecture can accommodate future feature expansions.

Later on, you’ll be able to expand the functionality of the app based on customer surveys, A/B testing, and your evolving vision of the product.

6. Integrating fintech API and data

The next thing shall be integration. Integration with financial institutions is often a necessity for fintech apps. Fintech APIs play an important role in facilitating seamless communication between the app and traditional financial services. You should establish strategic partnerships with banks and payment gateways to enable secure and efficient transactions. Plus, we encourage implementing key considerations for successful data integrations at this stage.

7. Prioritizing fintech UX design

A seamless and intuitive user experience is a hallmark of successful fintech apps. What exactly we mean here is:

- Intuitive navigation: designing an intuitive and user-friendly interface with straightforward navigation.

- Accessibility: ensuring the app is accessible to users with diverse needs and preferences, adhering to accessibility standards.

- Responsive design: creating a responsive design that adapts seamlessly to various devices, providing a consistent experience across platforms.

And of course, continuous user testing should be conducted to identify and address any usability issues. And one more word about testing.

8. Testing and quality assurance

Thorough testing is indispensable in both the web and mobile app development process. From functional testing to security testing, you must conduct comprehensive quality assurance checks to identify and rectify any bugs or glitches before the app’s launch.

9. Releasing your fintech app

At this exciting point, we recommend applying Continuous Integration/Continuous Deployment (CI/CD), that is to say: leveraging CI/CD pipelines to automate the deployment process. This ensures consistency, reduces the risk of human error, and facilitates rapid updates in response to user feedback or emerging issues.

10. Doing a post-launch review

After the initial launch, a post-launch review is critical in evaluating the app’s performance and user reception. Analyzing user feedback, monitoring key performance indicators (KPIs), and addressing any unforeseen issues are integral steps in refining the app for sustained success. Don’t forget to integrate mechanisms for collecting user reviews within the app to understand user preferences, pain spots and manage customer sentiments.

Conclusion

That’s it. Now you are aware of the minimum set of how to build a fintech app. However, the launch of a fintech app is not the end but a new beginning. You should be committed to continuous improvement and innovation, regularly updating the app to incorporate new features, AI-powered tools, chatbots, and user feedback, fixing issues, and staying competitive in a dynamic market. Staying ahead of technological trends ensures the long-term success and relevance of the fintech app.

To conclude, we’d like to say that by combining technical expertise, regulatory compliance, and a commitment to user satisfaction, you can navigate the complexities of fintech app development and create a transformative digital solution. We hope this guide will be key to sustaining the app’s relevance and success. Anyway, if you want to ask us more, it’s time to contact us. See you soon!